Abstract

Between December 7 and 13, strong inflows into BTC and ETH ETFs pushed BTC above $100K, while altcoins saw a sharp flash crash and massive liquidations. Stablecoin issuance and on-chain data suggest ample liquidity, with a BTC supply-demand imbalance potentially paving the way for future price increases. The upcoming US Federal Reserve meeting and holiday effects may influence market sentiment and liquidity.

Takeaway Message

- BTC and ETH ETFs Drive Market Stability: Inflows into BTC and ETH ETFs help stabilize the market, though altcoins remain volatile.

- BTC Supply-Demand Imbalance: Declining BTC exchange balances and rising stablecoin issuance may support BTC price growth.

- Impact of Fed Rate Cut and Holiday Liquidity: The expected Fed rate cut could boost crypto, but reduced holiday liquidity might increase volatility.

1. Overall Trend

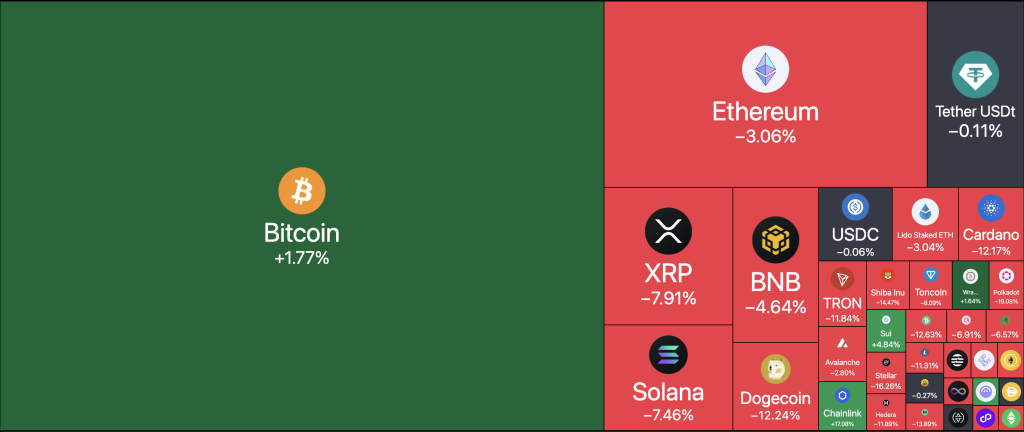

Figure 1. Crypto Asset Heatmap over Week, TradingView

Last week, the crypto market witnessed significant traditional capital inflows, with BTC ETFs experiencing a net inflow of over $2 billion. This surge helped BTC break through the $100K mark, now fluctuating in the $101K range. ETH, despite initially breaching the $4K level, faced some setbacks, yet the ETH ETF saw a net inflow of $800 million for the week, signaling strong buying momentum.

Trump-associated project World Liberty Finance made substantial secondary-market purchases of ETH, AAVE, and LINK, propelling these tokens into the spotlight. Meanwhile, MicroStrategy’s stock continued to climb, and its inclusion in the Nasdaq-100 index suggests increased passive institutional buying in the future.

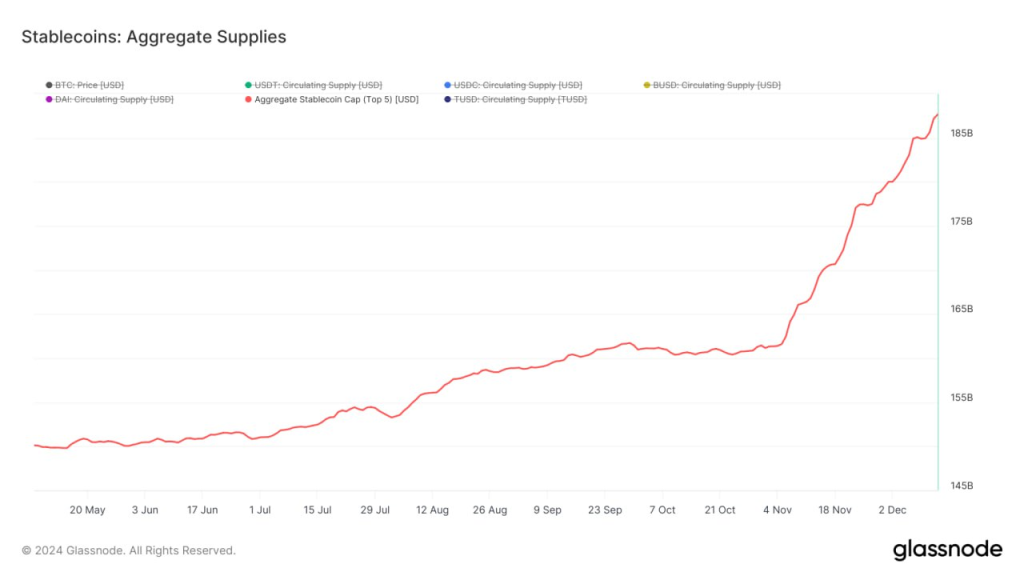

Figure 2. Stablecoin Total Supply, Glassnode

Looking at the stablecoin market, last week saw a significant increase in stablecoin issuance, surpassing $2.6 billion. This robust growth trend remains persistent, suggesting that liquidity support for the crypto market will continue to rise at a rapid pace.

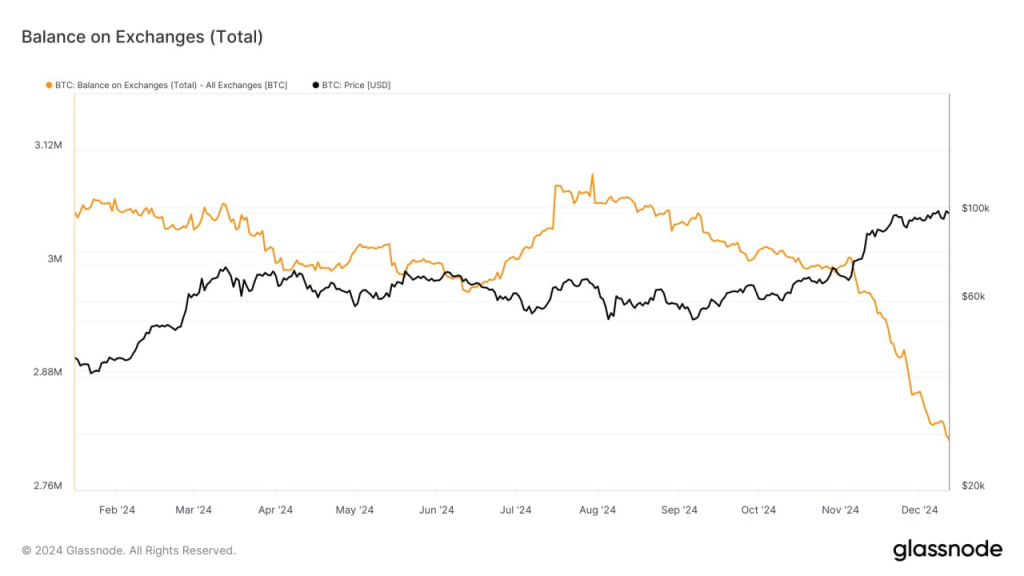

Figure 3. BTC Exchanges Balance, Glassnode

BTC balances on exchanges have continued to decline, with a reduction of approximately 20,000 BTC this week, worth about $2 billion. This trend closely mirrors the BTC ETF inflows. As BTC on exchanges drops and stablecoins continue to be minted, it sets the stage for an imbalance in BTC supply and demand, paving the way for a potential upward price breakout.

2. Crypto Derivatives Market

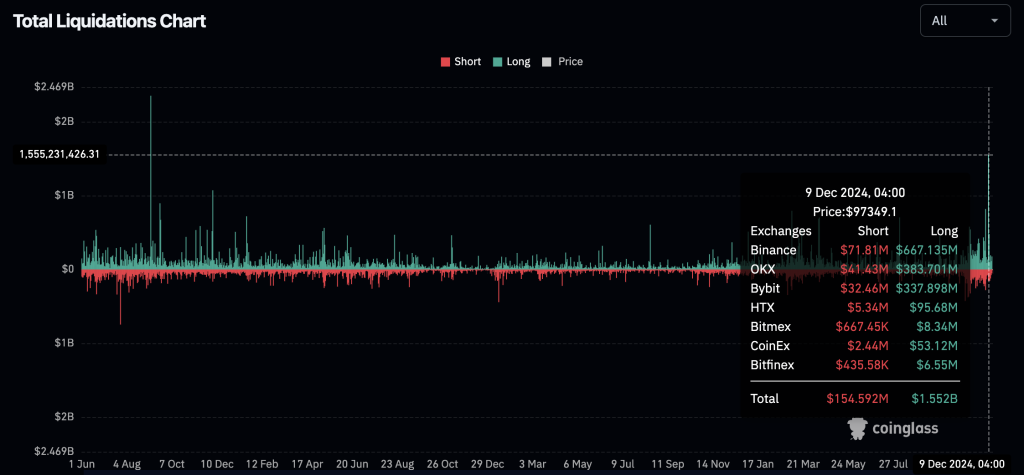

Figure 4. Total Futures Liquidations Chart, Coinglass

On December 9th, altcoins experienced a flash crash, with most altcoins plummeting 20-40% within 4 hours. This triggered massive liquidations in the futures market, totaling over $1.7 billion, including $1.55 billion in long liquidations. This marked the highest liquidation volume since September 2021, signaling a collapse in bullish sentiment.

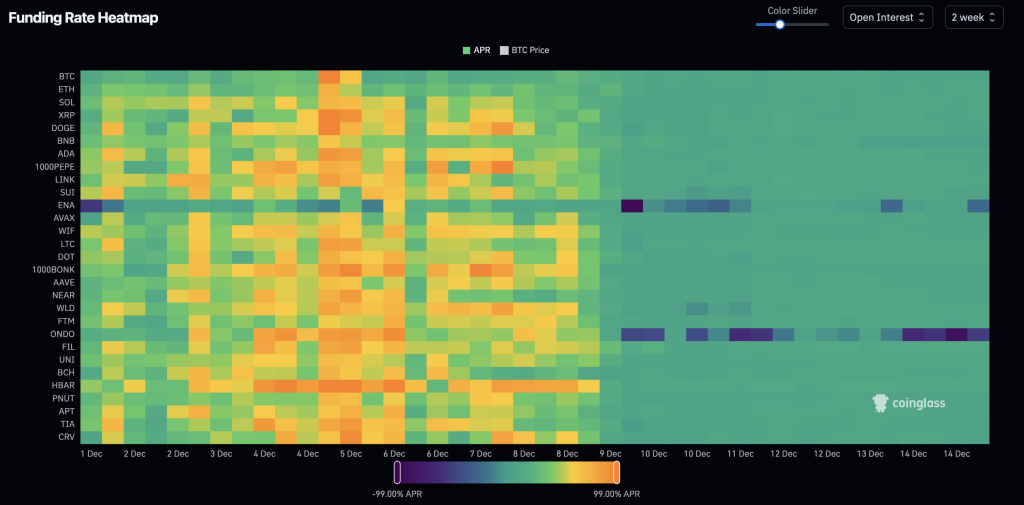

Figure 5. Funding Rate Heatmap, Coinglass

Following the flash crash on December 9th, the funding rates for most futures contracts dropped noticeably, with rates falling to an annualized level of about 10%. ENA and ONDO saw negative funding rates, indicating heavy buying power on spot assets, which caused spot prices to exceed futures prices. These assets may see significant price movements in the near future.

Figure 6. Exchange BTC Futures Open Interest, Coinglass

BTC futures open interest has risen to pre-crash levels, with CME open interest reaching new historical highs. This suggests a clear trend of traditional capital inflows. The influx of speculative capital has also contributed to BTC’s stable price movement.

3. On-chain Data

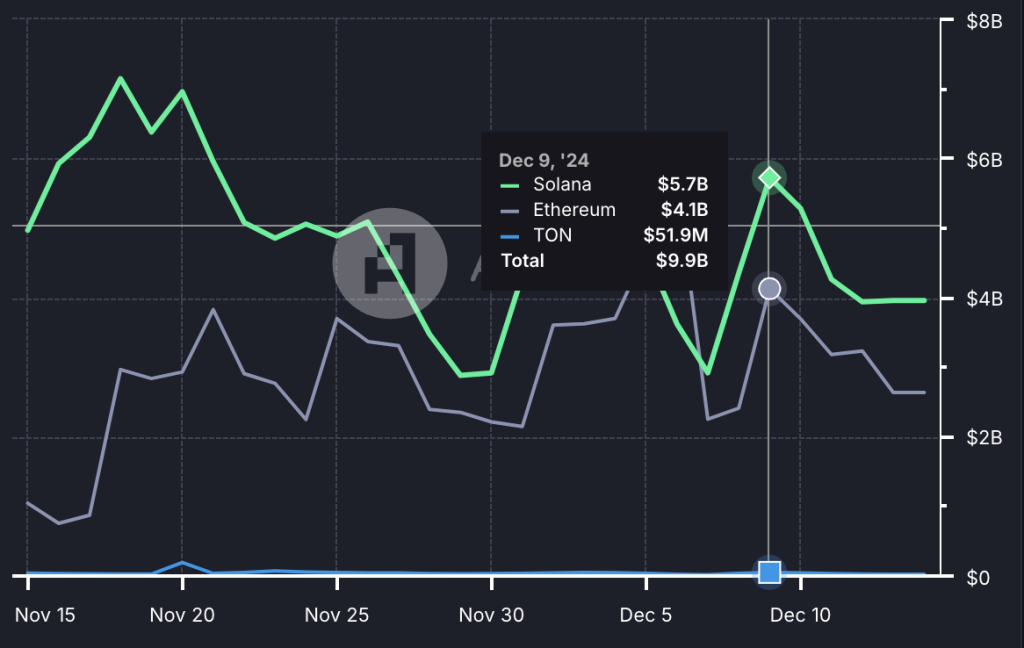

Figure 7. Solana\ETH\TON DEX Trading Volumes, Artemis

On-chain data shows that DEX trading volumes on both ETH and Solana chains have dropped by more than 30% this week, reflecting a cooling off in meme coin enthusiasm. However, AI Agent-related meme tokens are still showing strong wealth effects. AI Rig Complex (ARC), following its release on Pump.fun, surged by 5x within three days, demonstrating a noticeable wealth effect.

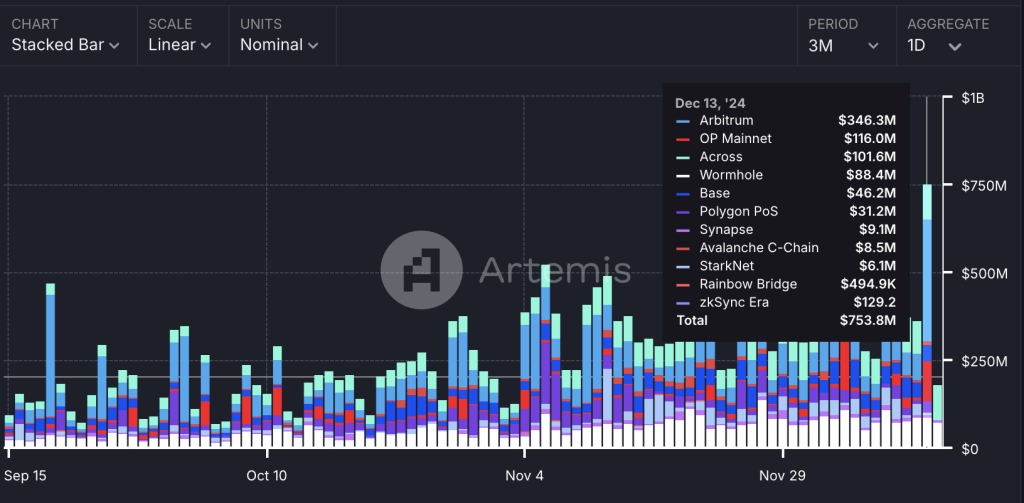

Figure 8. Bridge Volume by Protocols, Artemis

Regarding cross-chain data, Arbitrum’s bridge saw the highest cross-chain volume this week. The primary driver was the continuous price rise of Hyperliquid’s native token HYPE, which has surged more than 7x since its TGE. Hyperliquid, a derivatives trading platform built on Arbitrum, is drawing significant attention, with funds flowing through Arbitrum to the platform in a fervent speculative environment.

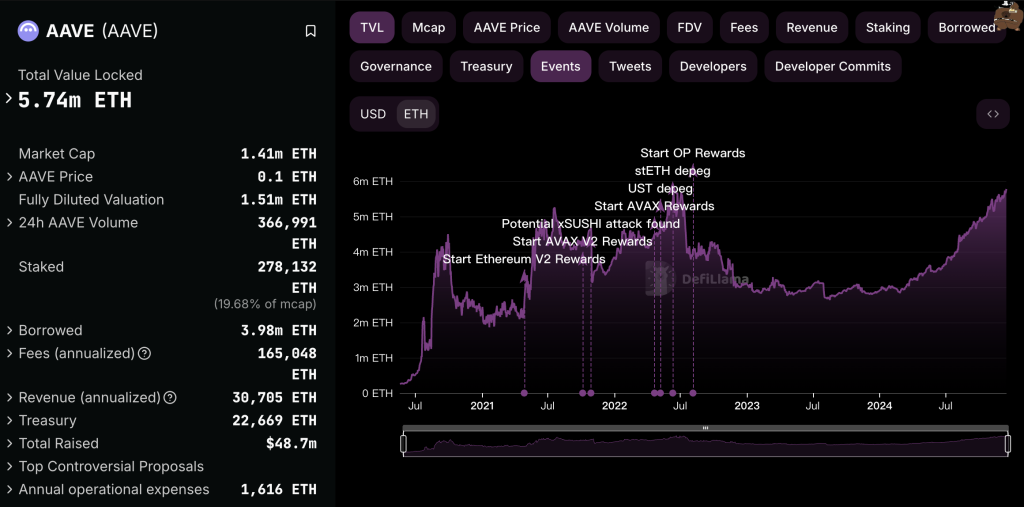

Figure 9. AAVE TVL Data, DeFiLlama

AAVE tokens performed well this week. Aside from World Liberty Finance’s secondary-market purchases, AAVE continues to see an increase in the amount of ETH locked in its protocol. As a leading DeFi lending platform, AAVE’s decision to repurchase AAVE tokens in the secondary market using profits is one of the factors contributing to the token’s price rise.

4. Outlook for Next Week

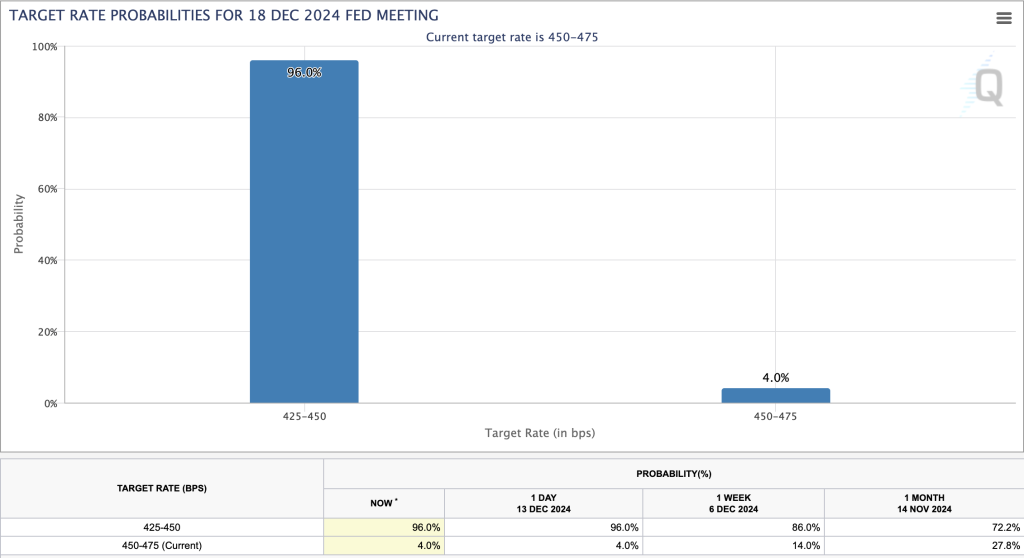

Next week, the key event for the crypto market will be the outcome of the US Federal Reserve’s final monetary policy meeting of the year, scheduled for Wednesday. According to current CME data, the market is pricing in a 96% probability of a 25bps rate cut, which would lower the federal funds rate to a range of 4.25–4.5%. A rate cut would be positive for risk assets, including the crypto market. However, prior to the announcement, the market may experience some risk-off sentiment. It’s important to pay attention to leverage positions, as extreme market fluctuations may trigger liquidation events.

Figure 10. CME FED WATCH

Additionally, as Christmas approaches, activity in both traditional capital markets and the crypto market is likely to slow. Trading volumes may decrease, leading to a potential liquidity shortage in some market areas. As the holidays near, altcoin activity is expected to decline. However, news flow around the festive season may trigger volatility, especially in meme markets. Keep an eye on the hottest meme assets on Pump.fun, as they may offer opportunities for early-stage high-alpha plays.

Finally, the sustained net inflows into BTC and ETH ETFs have been a strong market driver. If these funds see a sudden outflow, it could have a significant emotional impact on the crypto market. In such an event, reducing positions and holding stablecoins through the holiday period might be a prudent strategy.

No responses yet