Abstract

The cryptocurrency market remains in a consolidation phase, with Bitcoin (BTC) stabilizing below $100K and Ethereum (ETH) driving optimism across the broader ecosystem. Key indicators suggest the bull cycle is in its middle stages, with stablecoin inflows and altcoin dynamics supporting market liquidity. Macro events, institutional flows, and ecosystem developments will play a decisive role in shaping December’s performance for BTC and ETH.

Takeaway Message

- BTC Consolidation: Bitcoin continues to consolidate under $100K, with open interest trends indicating a capital shift towards altcoins.

- ETH Leadership: Ethereum’s strong rebound, coupled with DeFi growth and ecosystem innovations, positions it as a market leader.

- Macro Catalysts: Institutional interest, regulatory changes, and ecosystem token activity signal potential for both steady growth and short-term volatility.

1. Overall Trend

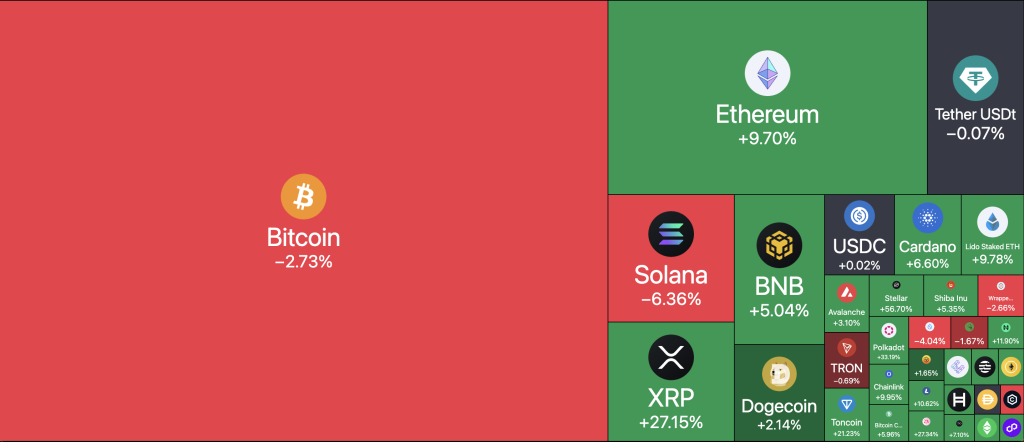

Figure 1. Crypto Market Weekly Heatmap, TradingView

Bitcoin traded within a range of $91,000–$100,000 this week, dipping by 2.73%. By contrast, Ethereum surged by 9.7%, climbing from $3,400 to $3,650. The ETH/BTC pair rebounded sharply, up nearly 20% over two weeks to 0.0381, hinting at a bottoming-out pattern.

- BTC Market Value to Realized Value (MVRV):

Figure 2. BTC MVRV Z-Scrore, Glassnode

The MVRV Z-score, currently at 2.8, remains well below the overbought threshold of 7, suggesting the crypto bull market is in its middle phase.

- Stablecoin Market Capitalization:

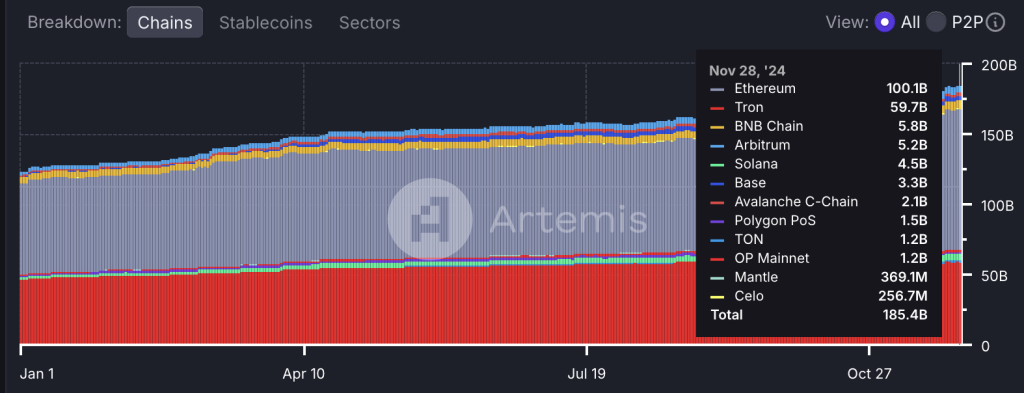

Figure 3. Stablecoin Total Supply, Artemis

Stablecoins added $1.3 billion this week, reaching $185.4 billion. This steady influx signals enduring liquidity support for altcoins, which may experience heightened activity over the next quarter.

2. Crypto Derivatives Market

- Funding Rates and Open Interest:

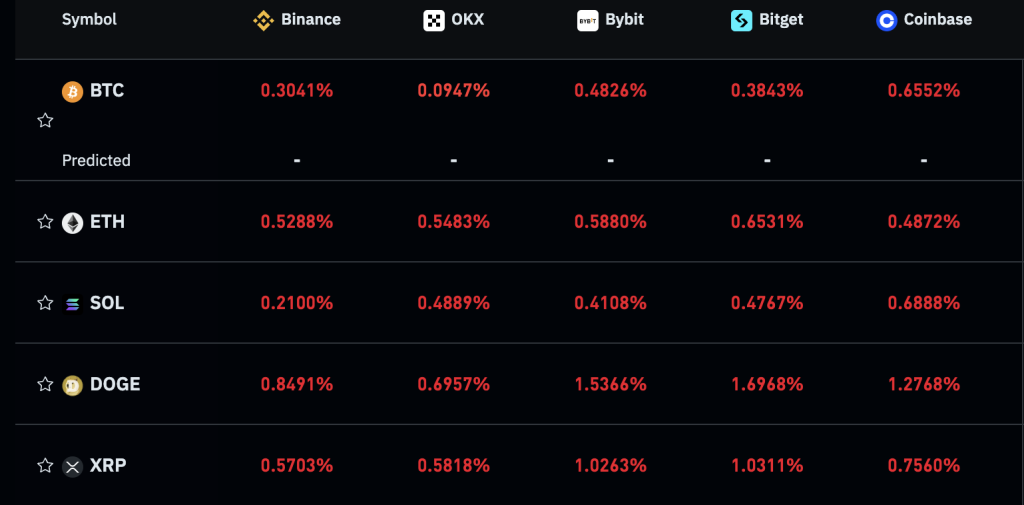

Figure 4. Core Crypto Assets Funding Rate over Major CEX, Coinglass

Weekly funding rates for Bitcoin ranged between 0.3%–0.6%, typical of a mid-bull phase. Open interest in BTC futures declined despite stable prices, indicating a redistribution of capital towards altcoins, a key indicator of “altcoin season” dynamics.

- Open Interest and Capital Flows:

Figure 5. BTC Open Interest and Price, Coinglass

Bitcoin’s open interest remains in a phase of high-level consolidation, but the steady decline in open interest indicates a lack of confidence in BTC’s short-term potential to surpass $100K. From the perspective of capital flows, hot money appears to be shifting from BTC to other ecosystems, which serves as a fundamental driver of altcoin season. Regarding future trends, monitoring changes in BTC’s open interest will be essential to assess the sustainability of altcoin season.

- ETH Options Skew:

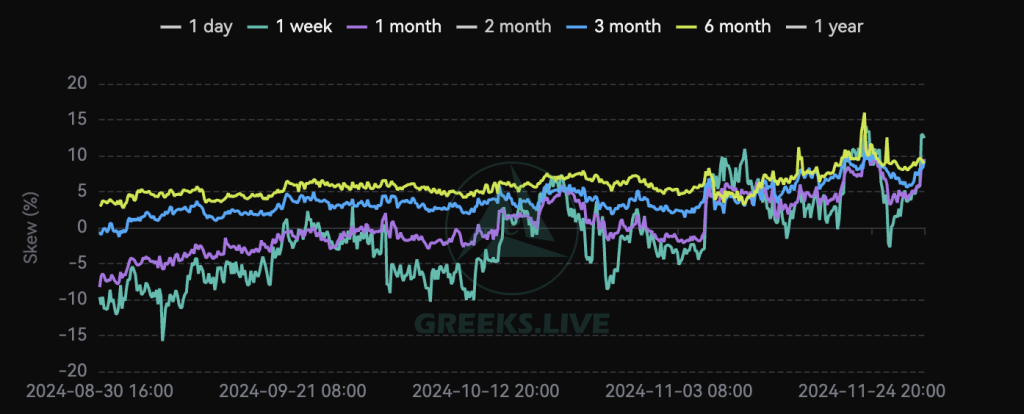

Figure 6. ETH Option Skewness, Greeks.live

ETH options skew for one-week contracts surged past the one-month, three-month, and six-month levels. This reflects short-term bullish sentiment, albeit at the risk of over-optimism, with potential for either continued upward momentum or abrupt corrections.

3. On-Chain Data

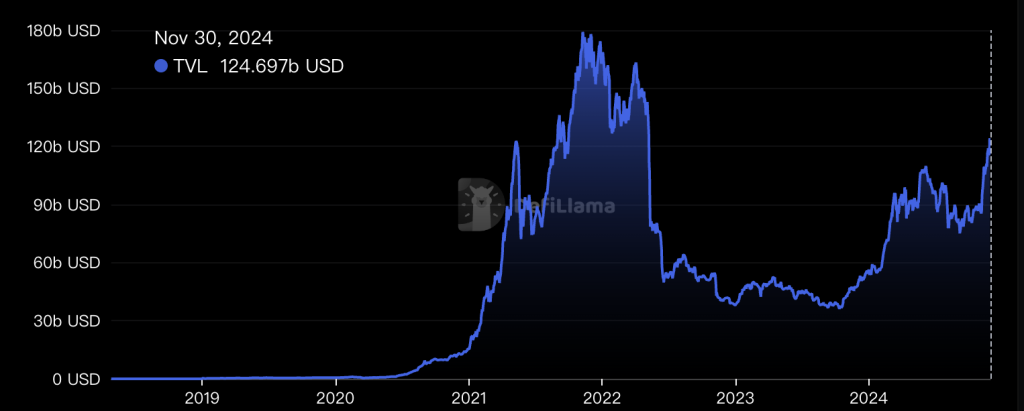

- DeFi Total Value Locked (TVL):

Figure 7. Total On-chain TVL over Time, DefiLlama

DeFi TVL climbed to $124.7 billion, marking a high since May 2022. This surge signals robust fundamentals for decentralized applications (DApps), with projects like AAVE, UNI, Banana Gun and ENA poised for potential upside. The token is highly likely to reach a new all-time high.

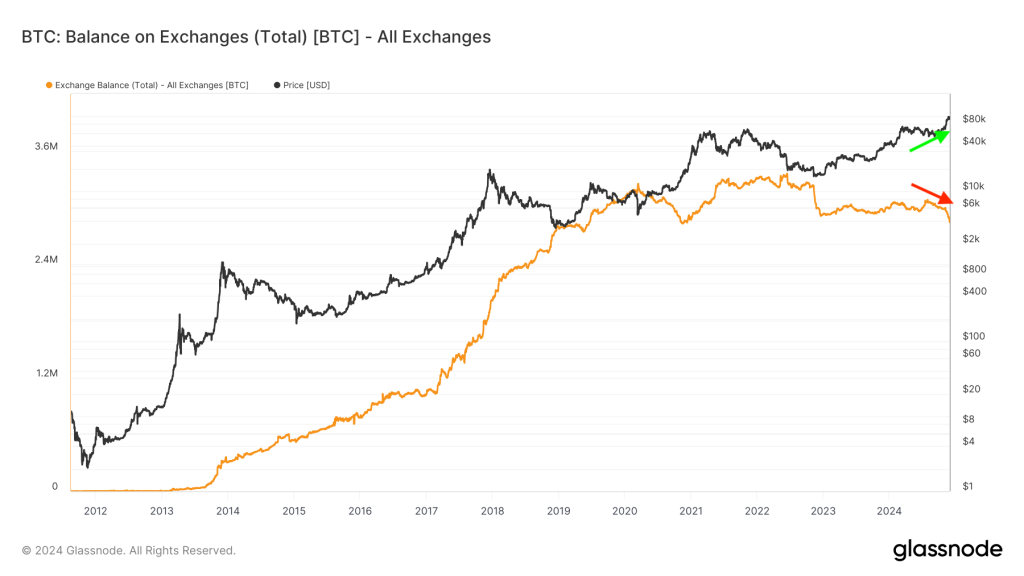

- BTC Exchange Balances:

Figure 8. BTC Balance on All Exchanges, Glassnode

Bitcoin balances on centralized exchanges fell notably as investors transferred holdings to cold wallets, reflecting confidence in BTC’s long-term prospects.

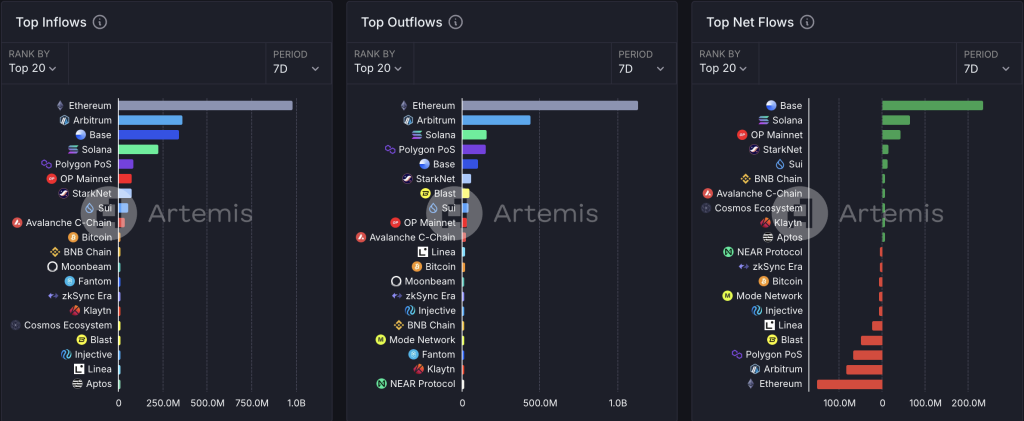

- Inter-Ecosystem Fund Flows:

Figure 9. Fund Flows Rotates among Different Eco, Artemis

Funds rotated from Ethereum, Arbitrum, and Polygon into Base and Solana, driven by speculative interest in meme tokens. Base alone attracted $236 million, fueled by projects like Clanker and Virtual.

4. Monthly Outlook for Core Assets

BTC and ETH performance in December hinges on three pivotal factors:

- Institutional Flows:

Bitcoin ETFs recorded $5.6 billion in net inflows for November, with Ethereum ETFs witnessing record single-day inflows of $300 million. Such trends signal growing traditional interest, particularly in Ethereum. - Stablecoin Growth:

Stablecoins expanded by $20 billion in November, offering sustained liquidity for the crypto market, a trend unlikely to reverse soon. - Macro Events:

- Microsoft’s potential BTC purchase, pending board approval, could catalyze a rally.

- The emergence of meme token platforms like Clanker on Base might rekindle Ethereum’s retail momentum.

- SEC leadership changes, with potential for crypto-friendly appointments, could shape regulatory narratives.

Price Ranges:

BTC is projected to fluctuate between $85,000–$120,000 in December, while ETH could trade within $3,000–$4,500. Although the probability of ETH surpassing its $4,900 all-time high remains low at 11.1%, renewed ecosystem enthusiasm may fuel a surprising rally.

No responses yet