Abstract

Bitcoin broke $100,000 this week, fueling market optimism and triggering heightened volatility. Institutional demand is growing as BTC’s supply on exchanges declines, while stablecoin inflows signal potential price upside. Meanwhile, DeFi assets and Solana-based meme coins are drawing increasing attention, positioning altcoins for potential growth in the coming weeks.

Takeaway Message

- Bitcoin Surge: Bitcoin’s recent surge past $100K signals strong institutional interest and increased demand for risk diversification.

- Crypto Marco: The current market dynamics, including a rise in stablecoin supply and reduced BTC supply on exchanges, suggest a potential for further price growth.

- Altcoin Focus: Altcoins, particularly meme coins and Solana-based projects, could experience sharp growth, making them key sectors for investor focus in the near future.

1. Overall Trend

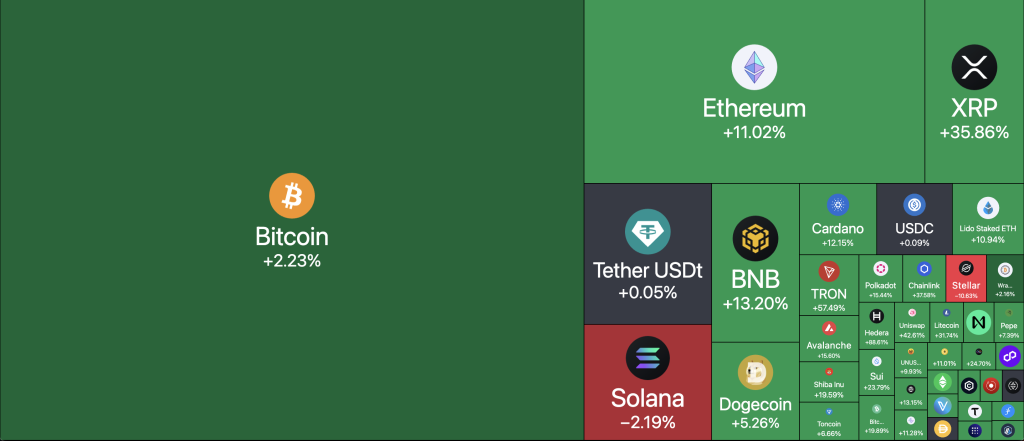

Figure 1. Crypto Market Weekly Heatmap, TradingView

This week, Bitcoin (BTC) broke through the psychological barrier of $100,000, showing strong upward momentum that fueled a wave of optimism across the market. However, this surge also led to a rise in the greed index, reaching a level of 85, indicating “extreme greed.” Additionally, the long position funding rate for BTC in the futures market rose to 0.09%.

For institutional investors, BTC continues to demonstrate a cyclical, low correlation with gold and the Nasdaq, making it an attractive asset for portfolio diversification. For both companies and individuals, BTC is seen as an effective hedge against inflation. In a recent statement, Federal Reserve Chairman Jerome Powell indicated that BTC’s most accurate benchmark is gold, not the US dollar, offering important guidance to traditional investors on how to view BTC as an asset.

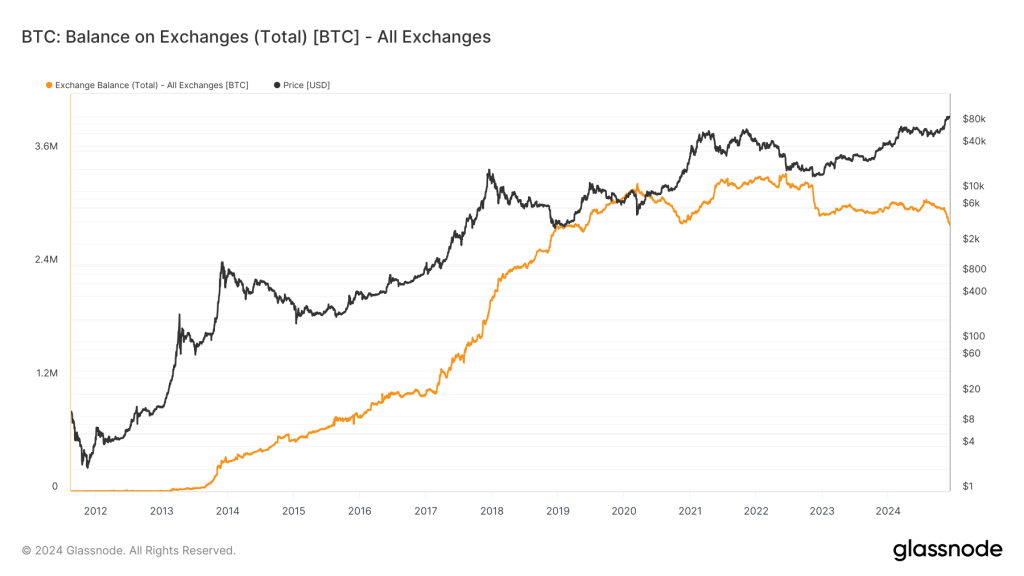

Figure 2. BTC Balance on Exchanges, Glassnode

Unlike the previous bull market, as BTC’s price gradually rises, the amount of BTC held on exchanges has been decreasing significantly. This suggests that large investors are increasingly purchasing and storing BTC, showing strong interest in holding rather than trading. Meanwhile, the supply of stablecoins on exchanges has been increasing, creating a supply-demand mismatch for BTC. This could potentially lead to a significant BTC price surge in the next 1-2 months.

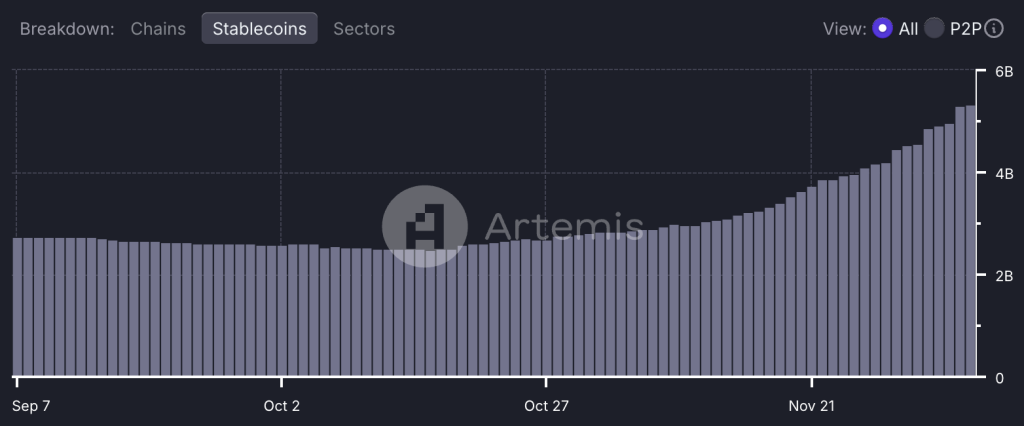

Figure 3. Ethena USDE Total Supply, Artemis

Ethena, an on-chain stablecoin issuer, backs its USDE with spot BTC and ETH with same amount of short position in the preps market, making it as delta-neutral portfolio. The profitability of Ethena is mainly driven by market funding rates. As funding rates in the futures market rise, the annualized yield of USDE has reached around 25%, driving strong market demand. This week, the total supply of USDE surged by nearly $800 million, reaching a historic high of $5.3 billion.

2. Crypto Derivatives Market

Figure 4. BTC Futures Funding Rate and Liquidations, Coinglass, Binance

This week, BTC’s price surpassed $100,000, triggering a short squeeze in the futures market. The forced liquidation of short positions drove BTC futures prices higher, causing the price spread between spot and futures markets to widen. As a result, the funding rate skyrocketed to an annualized 100%, indicating that long positions had no profitable ratio. The excessive funding rate forced futures market participants to exit their long BTC positions.

Less than a day after BTC surpassed the $100,000 mark, a sharp drop occurred, with BTC falling 10% to $90,500. In just one hour, $300 million in BTC long futures positions were liquidated, which helped bring the funding rate back to normal levels.

Figure 5. Total BTC Options Open Interest , Coinglass

The open interest in BTC options significantly decreased after BTC’s price surged above $100,000 and then retraced to $90,500. Both long and short positions suffered heavy losses, indicating that the market underwent a healthy deleveraging process.

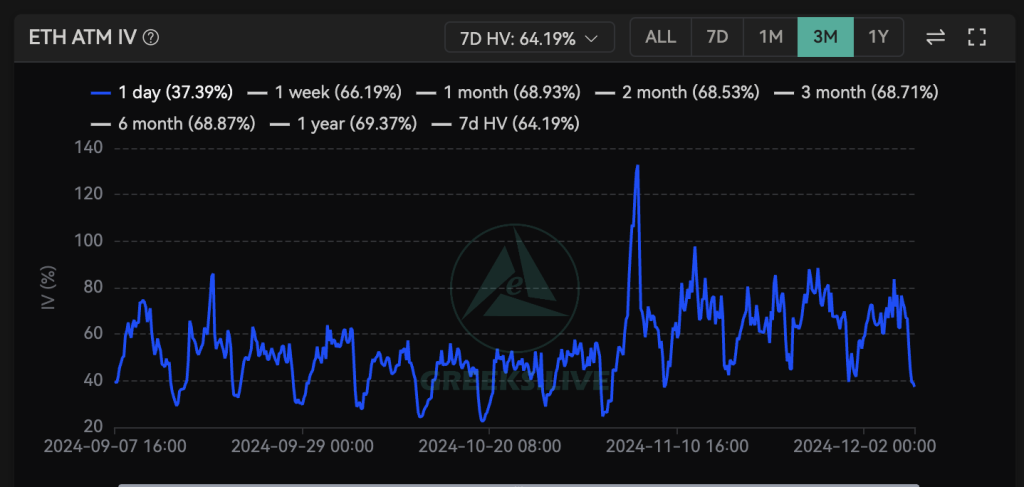

Figure 6. ETH Option ATM IV, Greeks.live

In the ETH options market, the price of one-day expiry options tends to drop significantly over the weekends. However, in recent weeks, ETH’s volatility on weekends has remained just as high as during the week. As a result, a potential trading strategy has emerged: going long on volatility over the weekend and shorting volatility during the week.

3. On-chain Data

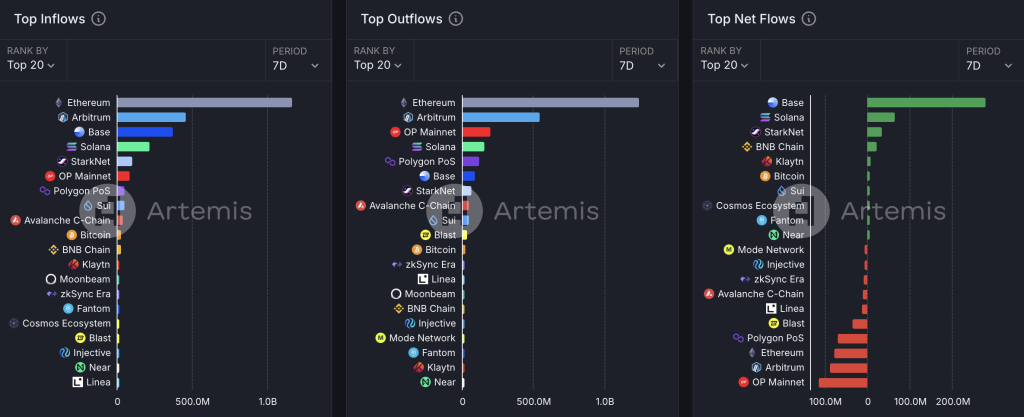

Figure 7. Fund Flows Rotate Among Different Ecosystems, Artemis

In terms of on-chain fund flows, the BASE ecosystem has continued to attract significant attention, with $280 million in net inflows last week. This indicates that the market has a favorable view of Clanker’s tokenomics and the narrative surrounding AI Agents. Meme coins also remain a popular area, with $65 million in net inflows last week.

Figure 8. DeFi Total TVL, DeFillama

With ETH breaking the $4,000 mark this week and stabilizing above $3,900, the total value locked (TVL) in the DeFi ecosystem continued to rise rapidly. The market’s total TVL now stands at $136.6 billion. DeFi assets also saw widespread gains last week, including UNI, AAVE, LDO, COMP, and SUSHI.

4. Outlook for Next Week

Market Dynamics & Mainstream Assets: Following this week’s price swings and the healthy deleveraging process, the funding rates in the derivatives market have seen a significant drop. Over the next week, it is likely that capital will flow back into mainstream assets, with BTC potentially pushing past the $100K mark again and ETH poised to break through $4,000 for further gains.

Altcoins & Market Strategy: When BTC and ETH experience short-term corrections, altcoins often rise dramatically. Keeping a close watch on altcoins is recommended, and if any show signs of breaking past previous highs, quick analysis and decision-making will be essential. In a liquid market environment, altcoins that break new yearly highs can often create a sustained uptrend, presenting favorable participation odds.

Meme Coins & Solana Ecosystem: Meme coins, particularly within the Solana ecosystem, are showing signs of explosive growth. Magic Eden, a leading Solana project, is set to release new tokens next week, drawing increased investor attention to the Solana ecosystem. In this environment, meme coins on Solana are likely to experience sharp, short-term gains. It’s advisable to monitor new projects and innovative plays on Solana’s Pump.fun platform, where small investments can potentially yield significant returns in meme coin speculation.

No responses yet